Use Case: Investing with the Zettelkasten Method

I am not an investment professional. I do invest in stock and some other assets to create passive income through dividends and to build a safety net. I don’t make the time-commitment for in-depth research. I merely want to avoid dumb decisions.

So I created a table of conditions that a company needs to meet before I buy stock. This is a snapshot in time. It is a work in progress of course:

| Metric | Good | Super | Dumb | No | Reference |

| -------------- | ----- | ---- | ----- | ------- | ---------------- |

| PEG-Ratio | <1 | <1,3 | >1 | | |

| Payout-Ratio | <100% | <55% | >100% | | |

| Divid.yield | >0% | >4% | 0 | | |

| Conseq. Divid. | >10 | >25 | 0 | | [[202007291035]] |

| Free Cash Flow | | | | | [[202008281429]] |

| P/E ratio | | | | | |

| Price-Share-Ratio | | | | | |

| Total Price | | | | | [[202008281434]] |

| Revenue | + | ++ | ± o. +/- | - o. -- | [[202010240857]] |

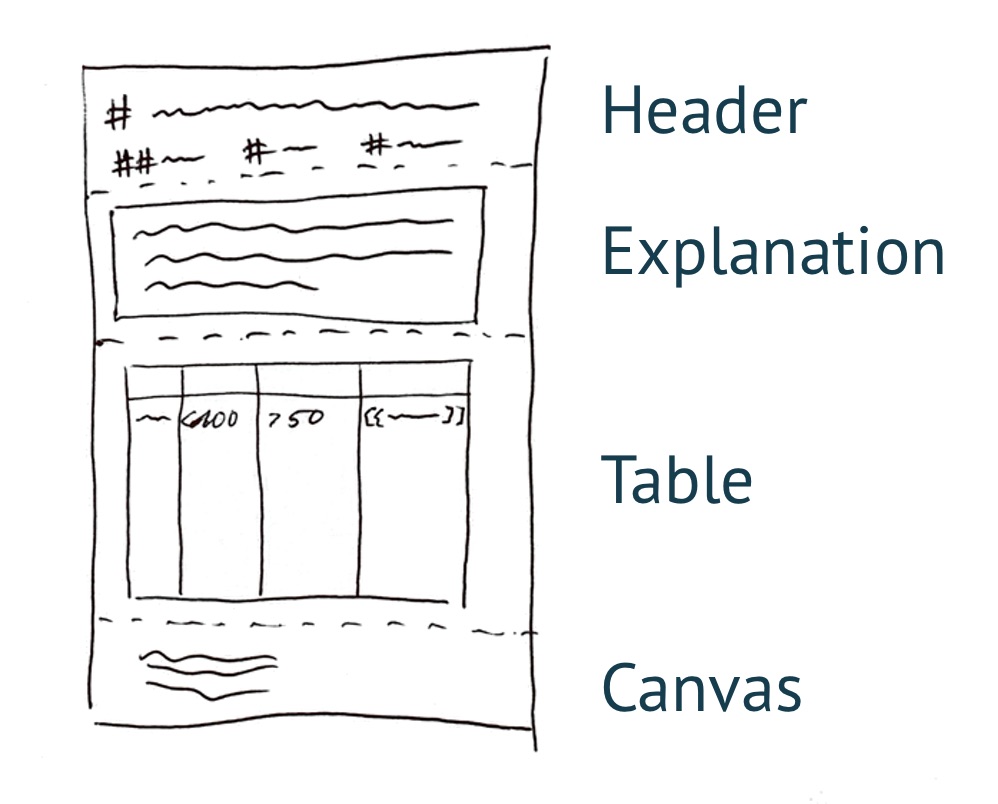

The corresponding Structure Note is divided up into three parts:

- The first subsection is the explanation of this table. It’s just a paragraph that roughly translates to: “The knockout method of investing means that every investing decision should be guided by knockout criteria. If a stock does not meet even one of those criteria then it is not worth the investment.”

- The second subsection has this table in it.

- The third subsection is my thinking canvas on this method of investing.

The table is the central element that has a strong pull on all the notes on investing stock criteria, metaphorically speaking. I link to them in the “references”-column. Whenever I learn something new on investing in stock I go to this structure note and try to improve the metrics in question. So, there is a strong tag ##stocks (in German, though) placed to enforce this habit.

Take-away

Many specific questions on the Zettelkasten Method shouldn’t be asked assuming that the Zettelkasten Method has a specific solution for that problem. You should rather figure out what you want to achieve, and then use the Zettelkasten Method to guide your steps and actions within your body of notes.

This three-part note for example is not something the Zettelkasten Method instructed me to do. Instead, I developed a practical tool that functions as a prism to focus my knowledge on stock evaluation. It happens to be a structure note.

It is very easy to get caught up in the details of features that the software you use offers, and even in the good practices of the Zettelkasten Method itself. The way out of this confusion is to take a step back and ask yourself: What do you need to craft to accomplish your task? What tool do you need? Then the Zettelkasten Method comes into play to guide your actions in organising the notes to support your task.

Christian’s Comment: When I read this for the first time, I thought this would be super useful for newcomers to the method. When we talk about Structure Notes, we usually talk about lists, table of contents style, and this could give a falsely strict impression. But we can create overviews in a lot of ways – images, graphs, or tables. If nothing else, this is a gentle reminder to not worry about the one true correct form of a Structure Note. Structures can take many forms.